A.L.I.C.E.

The Problem

Asset Limited, Income Constrained, Employed

42% of American Households Are Falling Behind Financially Every Month

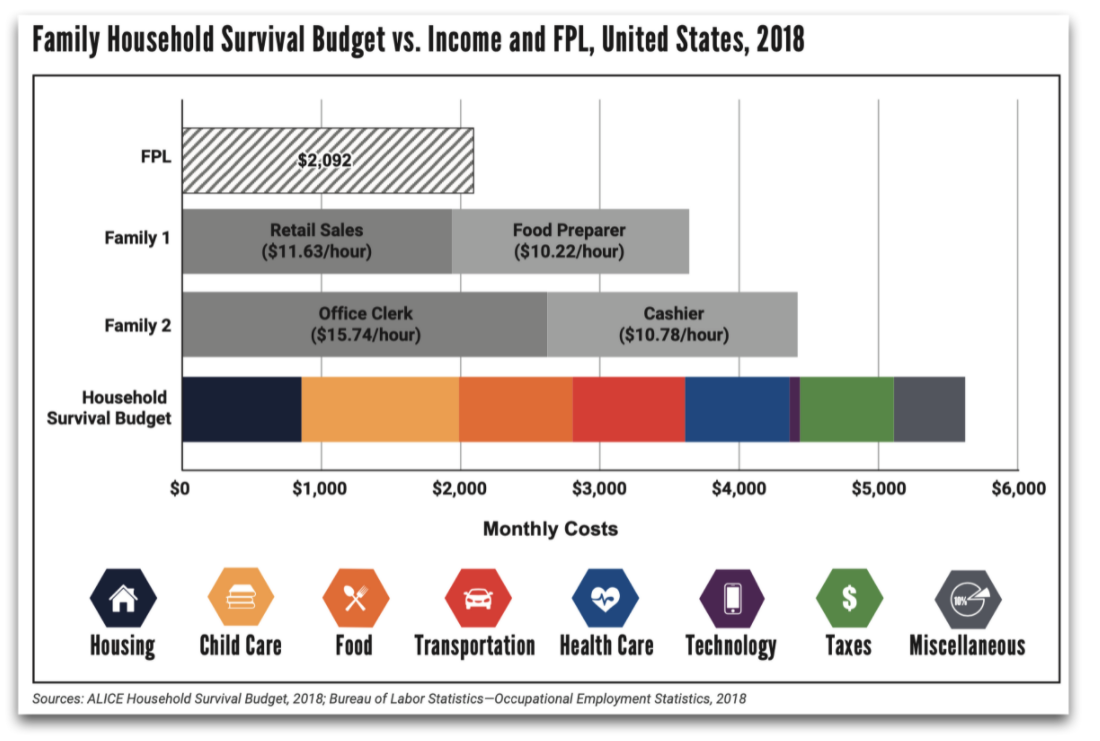

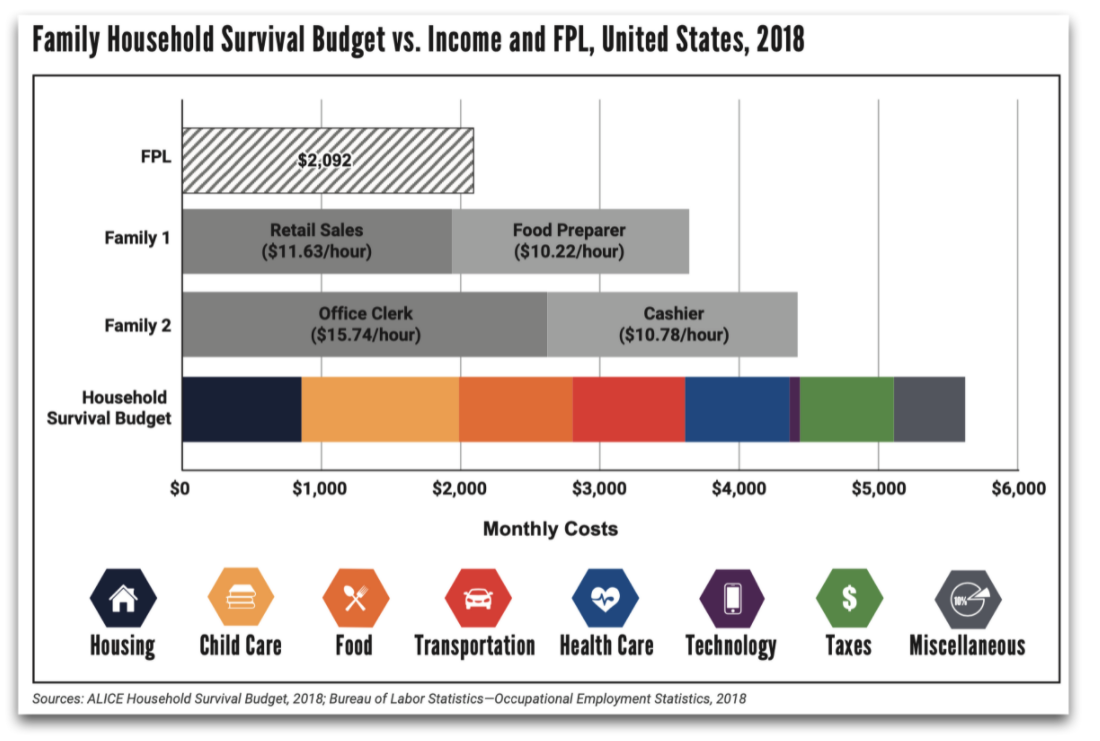

For far too many families, the cost of living outpaces what they earn. These households struggle to manage even their most basic needs – housing, food, transportation, child care, health care, and necessary technology.

When funds run short, cash-strapped households are forced to make impossible choices, such as deciding between quality child care or paying the rent, filling a or fixing the car.

A.L.I.C.E., (an acronym for Asset Limited, Income Constrained, Employed), is a new way of defining and understanding the struggles of households that earn above the Federal Poverty Level, but not enough to afford a bare-bones household budget. These short-term decisions have long-term consequences not only for ALICE families, but for all of us.

For far too many families, the cost of living outpaces what they earn. These households struggle to manage even their most basic needs – housing, food, transportation, child care, health care, and necessary technology.

When funds run short, cash-strapped households are forced to make impossible choices, such as deciding between quality child care or paying the rent, filling a or fixing the car.

A.L.I.C.E., an acronym for Asset Limited, Income Constrained, Employed, is a new way of defining and understanding the struggles of households that earn above the Federal Poverty Level, but not enough to afford a bare-bones household budget. These short-term decisions have long-term consequences not only for ALICE families, but for all of us.

Hiding in Plain Site

America’s Biggest “Hidden” Problem

Living Below the A.L.I.C.E. Threshold

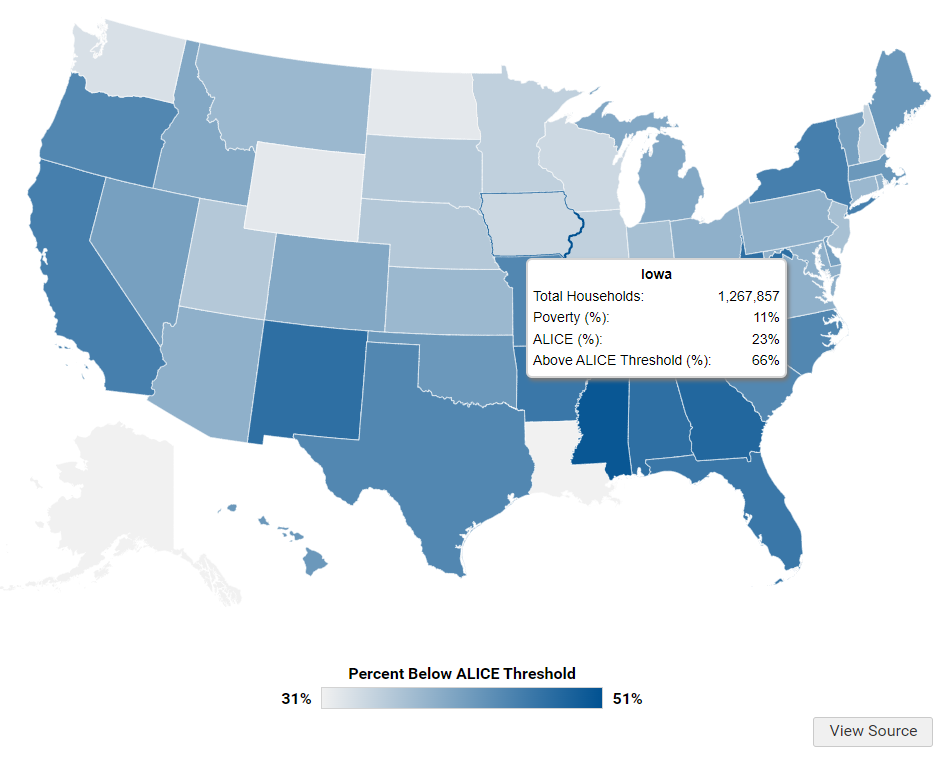

Through research from the United Way ALICE Project we can now see the percentage of households in each state which are living below the A.L.I.C.E. Threshold and it currently ranges from 31% to 51% depending on the state.

Living Below the A.L.I.C.E. Threshold

Through research from the United Way ALICE Project we can now see the percentage of households in each state which are living below the A.L.I.C.E. Threshold and it currently ranges from 31% to 51% depending on the state.

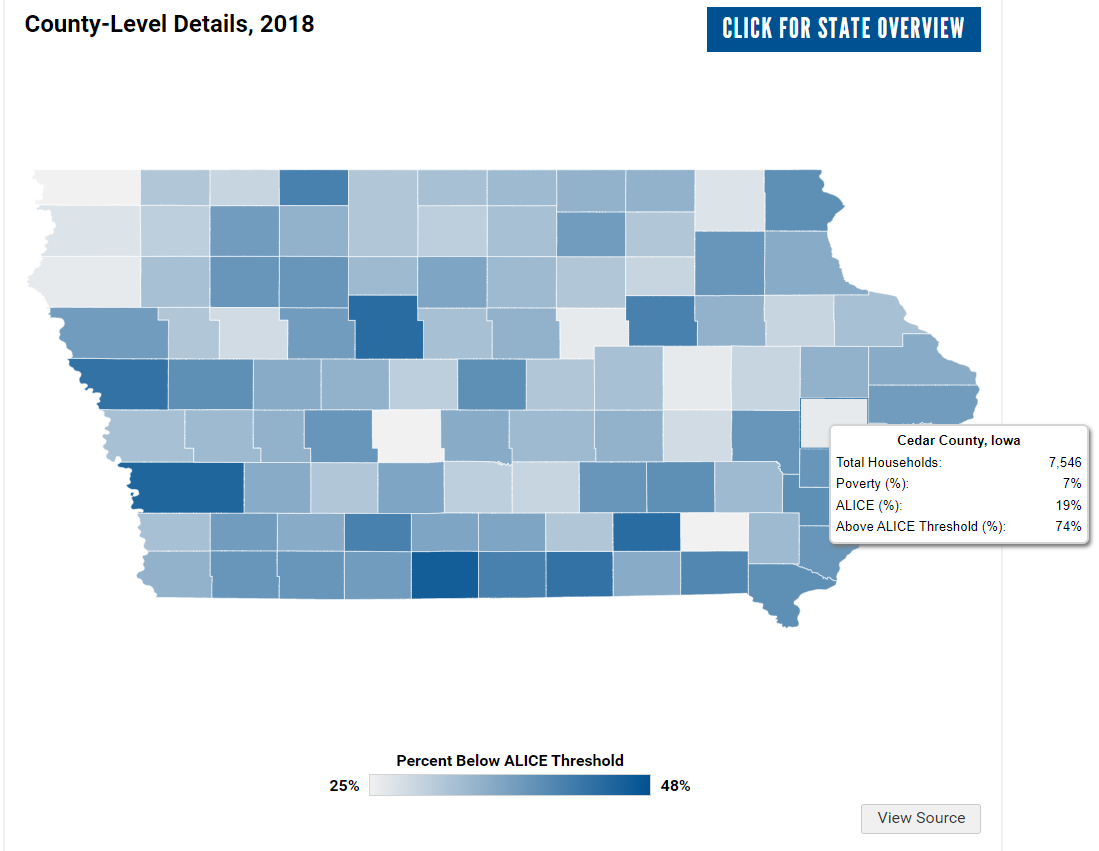

Cedar County, Iowa

Even further we are able to dive deeper into a county level to see the differences in the A.L.I.C.E. % in each county. The darker the blue color the worse off or higher the percentage of A.L.I.C.E. households in that county. For example, Cedar County has 7% of the population living below the A.L.I.C.E. threshold.

Monthly Income and Expenses

No Means To Escape Basic Survival

The Root Issue – High Interest Consumer Debt

“The average American Household is currently spending 25% of their take home income servicing high interest consumer debt.”

Unless we help these families bridge their cash flow without increasing high interest consumer debt and then helping them save for emergencies and ultimately pay down their debt, we will continue to be addressing negative symptoms of the household budget being out of balance rather than the root cause of it in the first place.

The Root Issue – High Interest Consumer Debt

“The average American Household is currently spending 25% of their take home income servicing high interest consumer debt.”

Unless we help these families bridge their cash flow without increasing high interest consumer debt and then helping them save for emergencies and ultimately pay down their debt, we will continue to be addressing negative symptoms of the household budget being out of balance rather than the root cause of it in the first place.

What Does A.L.I.C.E. Look Like?

Meet Charlene

Charlene is a northern New Jersey mother who works full time and is raising her two young sons. While Charlene works to improve the quality of area child care centers she struggles to provide for her family. Charlene is ALICE: Asset Limited, Income Constrained, Employed.